$100,000 for interests in real estate $50,000 for personal propertyģ0 days (if decedent died testate) 60 days (if intestate) Notary Public and Two (2) Disinterested Witnesses $20,000 non-spousal heirs $30,000 for surviving spouses who are sole heirs $50,000 for spouses, $20,000 for non-spousal heirs $100,000 for spouse $25,000 for other claimants $25,000 (excluding the value of one vehicle) $50,000 $100,000 for surviving spouses filing as sole legatee Notary Public or Judge/Clerk of the District Court

None $15,000 only when claiming funds in a bank account No Statute, but Death Certificate must be notarized $75,000 for tangible personal property $100,000 for real property

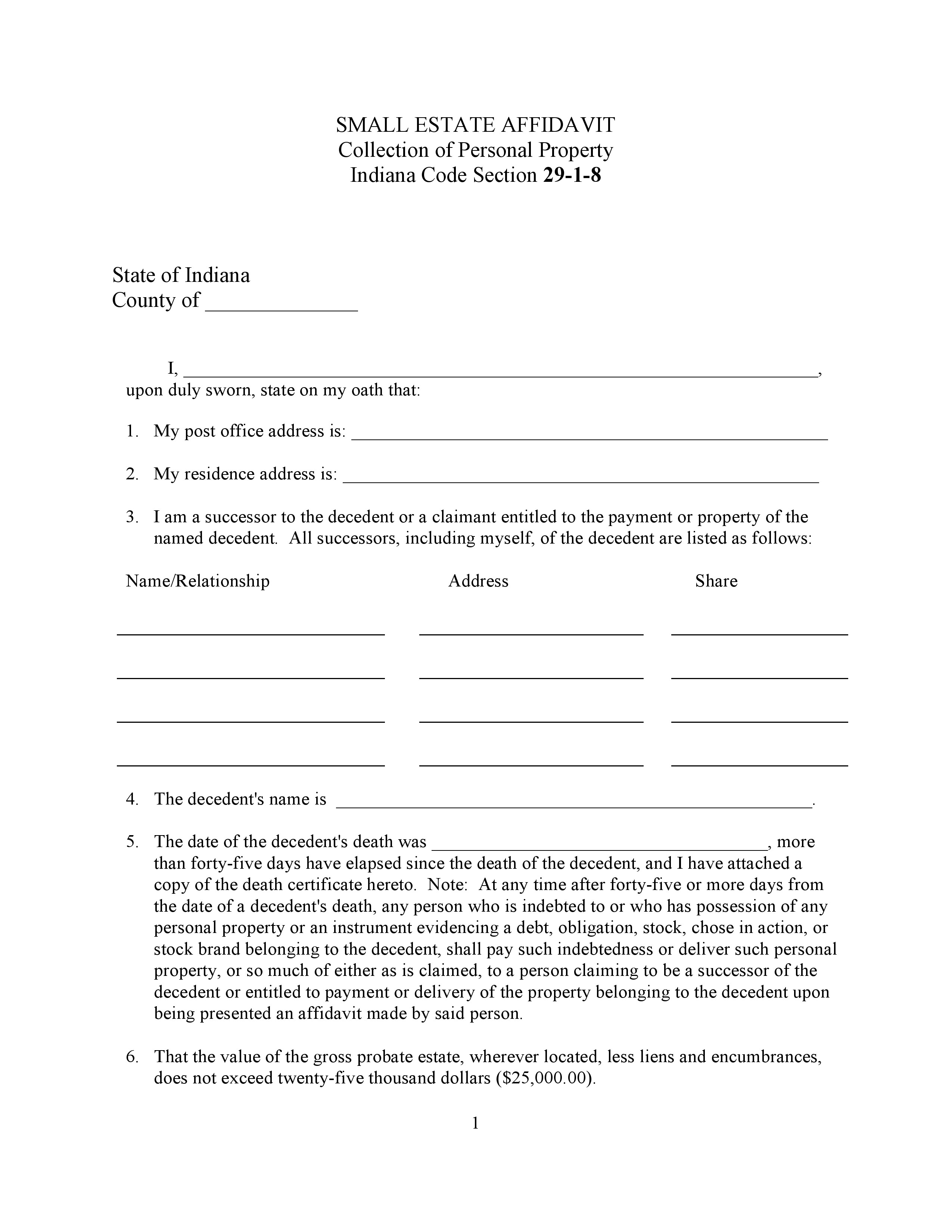

$100,000 for vehicles only $50,000 for other personal property Small Estate Affidavit vs Affidavit of Heirship.Step 5 – Contact Family Members (Heirs).Step 4 – Complete the Small Estate Affidavit.Step 1 – Wait for the State Required Time-Period.How a Small Estate Affidavit Works (6 Steps).State Requirements – There is a monetary limit ($) and minimum number (#) of days after the decedent has died before a small estate can be filed.

0 kommentar(er)

0 kommentar(er)